Currency Exchange : Cash? Credit Cards?

Gone are the days when traveler cheques offered a convenient way of bringing foreign currency into Thailand, and converting it into Thai bath in the country. Just received an e-letter from my European bank, pointing out what are the best ways of obtaining local currency when travelling abroad. There is no mention anymore of traveler cheques, and I assume that applies to services provided by most banks in the Western world. Truth be told, there may have been reasons to abandon them, but the system offered currency exchange rates that are not approximated by today's systems of exchange.

It seems the present recommendations in short are : bring a little bit of cash (for emergencies and when arriving at the airport), do the rest with credit cards (or some other kind of card provided by your bank). The result, without a doubt, is that you loose a few percent of your money when exchanging.

Thai banks, when they receive your cash money, and exchange it into Thai baht, make a profit on the transaction. Just checking the rates between buying and selling foreign currency, you can easily estimate the amount of money they are making. For example, today (somewhere in October 2021 in Covid-19 times), you get 33.56 baht when selling one dollar, and have to pay 34.26 baht to buy one (at SCB bank). So there is diffence of somewhat more than 2 % between buying and selling currency (and don't forget : you still get the best rates for U.S. Dollars). The same day, at about the same time, you get 33.83 baht for one dollar at Vasu Exchange on Sukhumvit, and you pay 33.93 baht to get one dollar. So just forgoing the banks and changing at Vasu Exchange (or SuperRich), you gain between 1 and 1.5 % for no additional effort.

ATMs are ubiquitous along Bangkok's streets, in supermarkets and department stores etc. It may be an expensive way to obtain money with your credit card though.

So far for the bad news (you loose money). The good news is that all Thai banks basically use the same exchange rates, updated frequently during the day. So no need to go shopping around at different banks.

So, Thai banks are getting competition from what we could call, dedicated money exchangers. This started around 2015. The best known service provider, with an expanding number of outlets around Bangkok (but some were closed during the Covid-19 pandemic), is Superrich Thailand . You get the best rates when buying or selling larger denominations, like 100 Dollar bills. Rates are slightly different when exchanging lower denominations, or when you do transactions outside their main outlet in the Pratunam area of Bangkok (somewhere opposite of the Central World Plaza).

There are convenient locations of Superrich Thailand at Siam Paragon, Emporium, MRT Sukhumvit, SUVARNABHUMI airport, Phuket International Airport, etc.

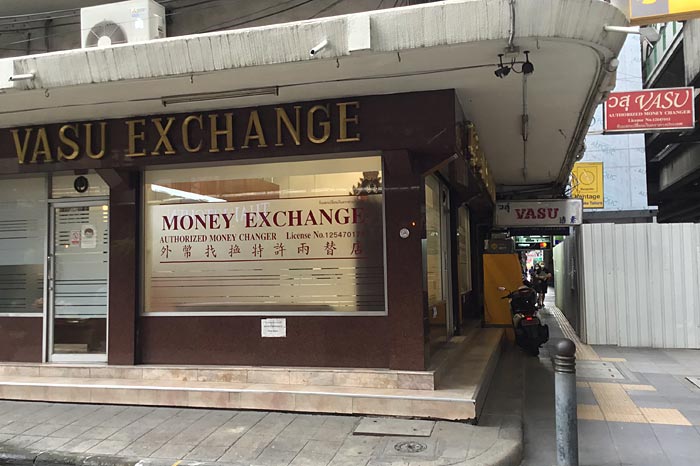

We have used a few times the services of Vasu Exchange at the entrance Sukhumvit Soi 7/1. The branch stayed open during the Covid pandemic, though with a greatly reduced customer number. It is not flashy at all, but the services are well organized, and not much waiting is involved. You have to bring your passport with you, and they may ask you to write down your address and telephone number.

When entering or exiting any money exchange, it is a good idea to be well aware of your surroundings. Of course, people in adjacent streets, know that you are carrying some money with you. So do not start talking with any person that accosts you.

In short, if you carry CASH money, we advise you to say goodbye to money exchanges at Thai banks, and use the services of dedicated money exchanges.

Now, what exchange rate to expect when you TRANSFER money from your European bank to you Thai bank account? U.S. Dollars or Euros, are automatically exchanged to Thai baht when the money arrives at your local Thai bank.

Vasu Exchange is located at the entrance to Soi 7/1 on Sukhumvit Road.

We tried this on a few occasions. With one bank, the money never seemed to have arrived in Bangkok. So we went to our local bank, and things were not immediately clear. Eventually they connected me by phone to the head office, and I was supposed to approve of an exchange rate (???). I did, and noticed later that I did not exactly get a good deal.

On another occasion (with another bank, 'a donkey does not bump into the same stone twice'), the Thai baht money was deposited in my account the next day. That's right, ordering one day with a European bank, the next day the money was in my account in Thailand. The downside : I did not get as good a rate as I expected, some 1 % disappeared, when comparing what I got with the prevailing rates at Superrich Thailand that day. Note that the money exchange takes place in Thailand, not in Europe, so any money that gets deducted is deducted in Thailand. Just a minimal nominal commission was paid in Europe.

Note : It may well be that when transferring small amount of money (af few thousand U.S. Dollars or Euros), everything goes 'automatic'. When transferring larger sums, you may need to be contacted by phone,etc. However, we could not give you an exact cut-off point, and it may be different depending on the banks used.

So, in conclusion, the best way to go about exchanging money :

1) Take cash, and exchange it with money exchangers (not banks) in Bangkok. This obviously assumes you trust you can keep your money safe at all times. Outside Bangkok, you likely will need to use banks, so take Thai baht from Bangkok. If you are not confident about this, use your credit card, and loose a bit of money.

2) Always have a credit card (or some other card provided by your bank, that allows you to exchange money) with you, for emergencies (like if you lost your money, or it was stolen). Of course, you may also use your credit card to obtain hotel rooms, airline transfers, etc. before you start off your trip,or while in Thailand. Just play around a bit by changing currency with the booking servives, and see how much they try to gain by currency exchange (we did not check into this). As a matter of fact, we advise to have 2 credit cards with you. Nowadays, it seems to happen occasionally that credit is denied, because the credit card provider, suspects some fraud is involved. This can be a very unpleasant experience if you are traveling abroad, and can not get easy contact with your bank etc.